by Victor Aboh

Introduction

When we think about philanthropy and charitable giving in Nigeria, we readily recall public figures such as Aliko Dangote (Founder, Aliko Dangote Foundation), Rochas Okorocha (Founder, Rochas Foundation), or Folorunso Alakija (Founder, Rose of Sharon Foundation) and the list goes on1. The truth, however, is that charitable giving in Nigeria goes far beyond what the ultra-wealthy give.

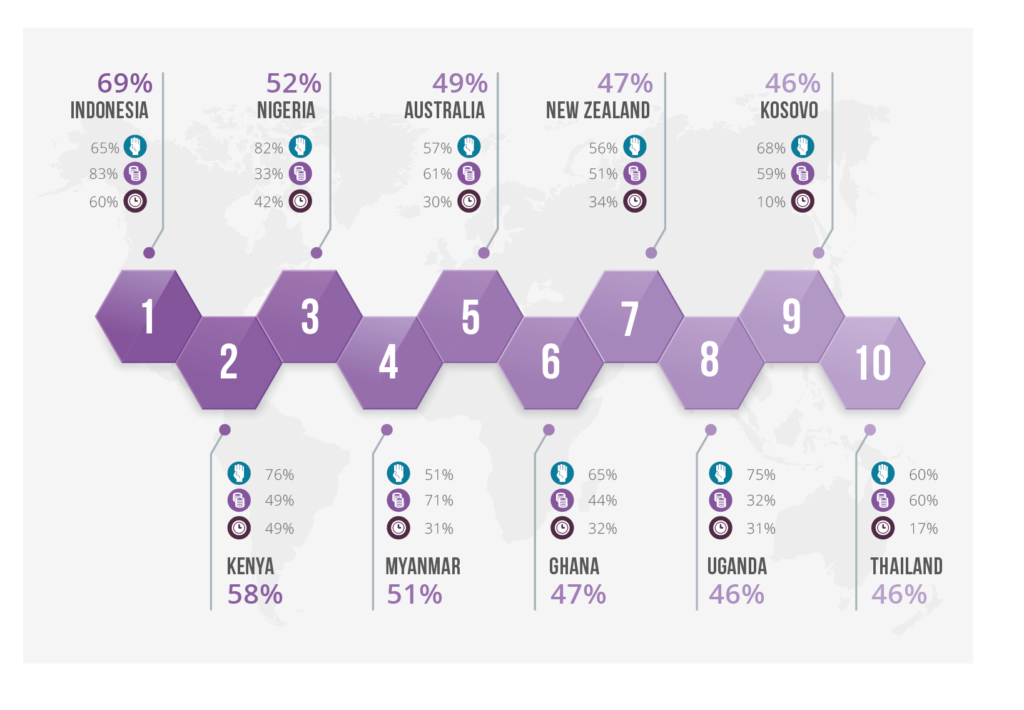

In 2020, Nigeria made the top 10 list of most generous countries globally for the first time, coming in third 2. Strikingly, Nigeria ranked 1st in the “Helping a stranger” category, scoring 82% 2. Unfortunately, the story of charitable giving in Nigeria is not all rosy. There remains a significant funding gap worth billions of dollars that an estimated 8,000 Non-profit organisations in the country continually try to fill 2 3. Open Banking presents some opportunities that Charities and NGOs can take advantage of to improve their overall outlook and fulfill their visions.

Flexible giving

While Nigeria ranked 1st in helping strangers, it ranked 46th in donating money. There are many reasons why giving in Nigeria is at this level – many Nigerians don’t necessarily know how to give to the organizations they care about, and the giving methods, while easy, are not necessarily convenient in many situations. In addition, most giving is limited to single customer-initiated transactions (bank transfers, POS Terminals, etc.), but global giving statistics show that “donors that set up recurring donations give 42% more annually, compared to one-time donations.”4

Additionally, micro-donations have been found to have a significant positive impact on NGOs that have embraced them. As it encourages small donation amounts, NGOs find a net increase in giving by first-time donors and re-engaged former donors5. In France, Ingenico recorded about 17 million micro-donations on their payment terminals, amounting to 4 million euros in 20196. Similarly, in the UK, the Pennies Foundation had an increase of £13.1m in micro-donations between 2020 and 20217.

Open Banking provides the needed infrastructure and technology that supports Variable Recurring Payments. It allows would-be donors to set donation ranges and monitor their giving transparently easily. This technology is already being used by a UK-based charity organization, Charity Right, and is enabled by NatWest8.

Startups, such as Pledjar, are leading the frontier in Micro-donation schemes such as “Rounding up” digital transactions, allowing users to donate spare change to their charity of choice. This simple action turns mindless daily commerce into charity-revenue-generating activities. In its first year of operation, Pledjar raised over £1m for charity in the UK.

Trust and Transparency

Trust is hard to earn in an environment such as Nigeria, where news of fraudulent actors taking advantage of the generosity of donors on crowdsourcing platforms such as GoFundMe is rampant. Charitable organizations need all the help they can get to prove they are legitimate and responsible in using donor funds. Charities need to improve their efficiency in providing publicly available and auditable financial reporting. NGOs can share their financial data easily with accredited Charity Watchdogs in a secure manner.

Open Banking allows charities (as well as other businesses) to facilitate easy-to-manage integrations between their business accounts and accounting/reconciliation software, allowing them to automate these activities and publish their financials quickly. In the US, Charities that received endorsement by a national charity watchdog saw donations increase by 53% on average9.

Conclusion

In conclusion, Nigerians are generous people. Despite the hardships of the economy, Nigeria continues to rank towards the top of the world’s most generous countries. However, with over 40.1% of Nigerians living below the poverty line10, over 60% lacking access to primary health care11, and over 30% illiteracy rate12, it is clear that Nigerian Charities need all the volunteers and donations they can get.

With Open Banking, Charities can democratize giving by utilizing micro-donation schemes, allowing them to break their reliance on potentially unreliable large donors. Additionally, Open Banking provides Charities and NGOs the tool kit to improve their financial transparency, allowing donors to gain more trust in their organizations and bring in repeat donations.

References

- [1] Top 10 Philantropists in Nigeria

- [2] CAF World giving index 2021

- [3] Guardian: 10 billion yearly donation can address Nigeria’s Woes

- [4] Online Giving Statistics

- [5] How micro-donations can make a big impact for your non-profit

- [6] Payments Journals: Ingenico processes record number of micro-donations on it’s payment terminals

- [7] charitycommision.gov.uk

- [8] https://www.bankofapis.com/customer-stories/charityright

- [9] The Importance of Fundraising Transparency

- [10] Nigerian Bureau of Statistics: Multidimensional Poverty

- [11] Six in 10 Nigerians lack access to primary health care services

- [12] Education Statistics for Nigeria